Target Audience:

College/NFL Coaches and Athletes

Common Problems:

- Financial Education,

- Budgeting and Savings Strategies,

- Tax Mitigation

- Organization of a team ex. Accountant and Attorneys when needed.

- Investment management

- Family

Scenario:

College Athlete is looking to enter the draft, or an athlete or coach may walk into a new contract negotiation. Various advisors and family members are reaching out to the individual. The athlete knows he doesn't want to make the wrong move with his money but doesn't know who to trust.

Solutions:

- We take it slow. We allow our athletes and coaches to become educated on their options before implementation. (ex. Taxes, investing, real estate, etc.)

- Break down the contract and recommend the best saving strategies to implement.

- Track the goal and adjust as new contracts and adjust as situations arise

- Don't complicate it? The simpler it is, the faster we can play.

- Start planning the exit. We help our clients look to the future and advance in areas outside the arena!

Outcome:

The client is educated on financial literacy and is equipped with the tools needed to walk through life confident that they’ve reached financial independence and mastered the necessary habits to carry them through the entirety of their life.

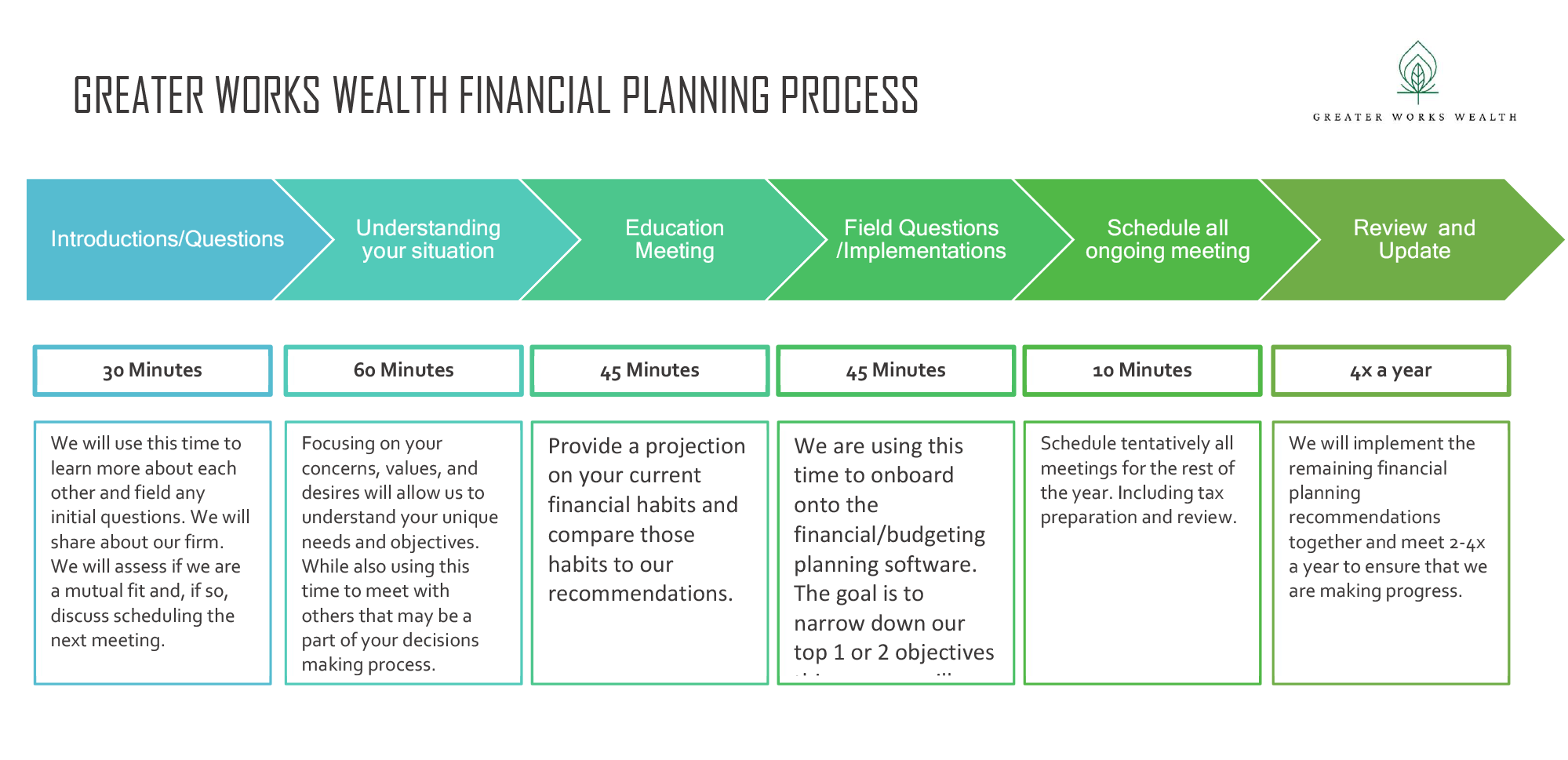

Process

Ongoing Financial Planning - Schedule A

We charge a recurring fixed fee for Ongoing Financial Planning. Fees are paid monthly or quarterly in arrears, ranging from $150 to $500 per month or $450 to $1,500 per quarter. The client can opt to pay an annualized fee at the end of the service. The fee range is dependent upon variables including the specific needs of the Client, complexity, estimated time, research, and resources required to provide services to you, among other factors we deem relevant. Fees are negotiable and the final agreed upon fee will be outlined in your Advisory Contract.

Wealth Management - Schedule A

The fee is based on a percentage of assets under management (“AUM”) and is negotiable. For accounts with more than $500,000 in AUM, investment management and financial planning services are included in the AUM fee. For accounts with less than $500,000 in AUM, the fee is a combined fee for investment management and for financial planning.

The annualized fees for investment management services are based on the following fee schedule:

Assets Under Management Annual Advisory Fee

$0 - $500,000 1.25%

$500,001 - $2,000,000 1.00%

$2,000,001 - $5,000,000 0.65%

$5,000,001 and Above 0.50%

The annual advisory fee is paid quarterly in arrears based on the average daily balance of the Client’s account(s). The advisory fee is a straight tier. For example, for assets under management of $2,000,000, a Client would pay 0.65%. The quarterly fee is determined by the following calculation: (($2,000,000 x 0.65)) ÷ 4 = $3,250.

Downloads

White paper: What should you consider starting out financially?