Target Audience:

Individuals and couples who want to know if they will outlive their money or if their money will outlive them.

Common Problems:

- Will I outlive my money?

- What do I do about Medicare?

- When should I use my pension?

- Investment Management

- How do I take money out of my 401k?

- Estate planning

- Long-Term care planning

Scenario:

A police officer is about to retire after serving 35 years. They saved into the 457B plan and will receive a dropback bonus once they retire. They don’t need the 401(k) money or the dropback but want to make wise choices.

Solution:

- Take time to think about what’s important to you and how you see this next chapter in life going in your ideal scenario.

- Stress testing that scenario to see if it can be achieved or are there adjustments we need to make.

- Understanding your risk tolerance. We educate our clients on how to protect their nest eggs through prudent investment management.

- We help out clients execute essential tasks.

- Review and adjust as life circumstances change.

Outcome:

The client feels excited about this new phase of life and confident about the ability to sustain the quality of living they want. Knowing that all controllable events have been accounted for and security for future generations.

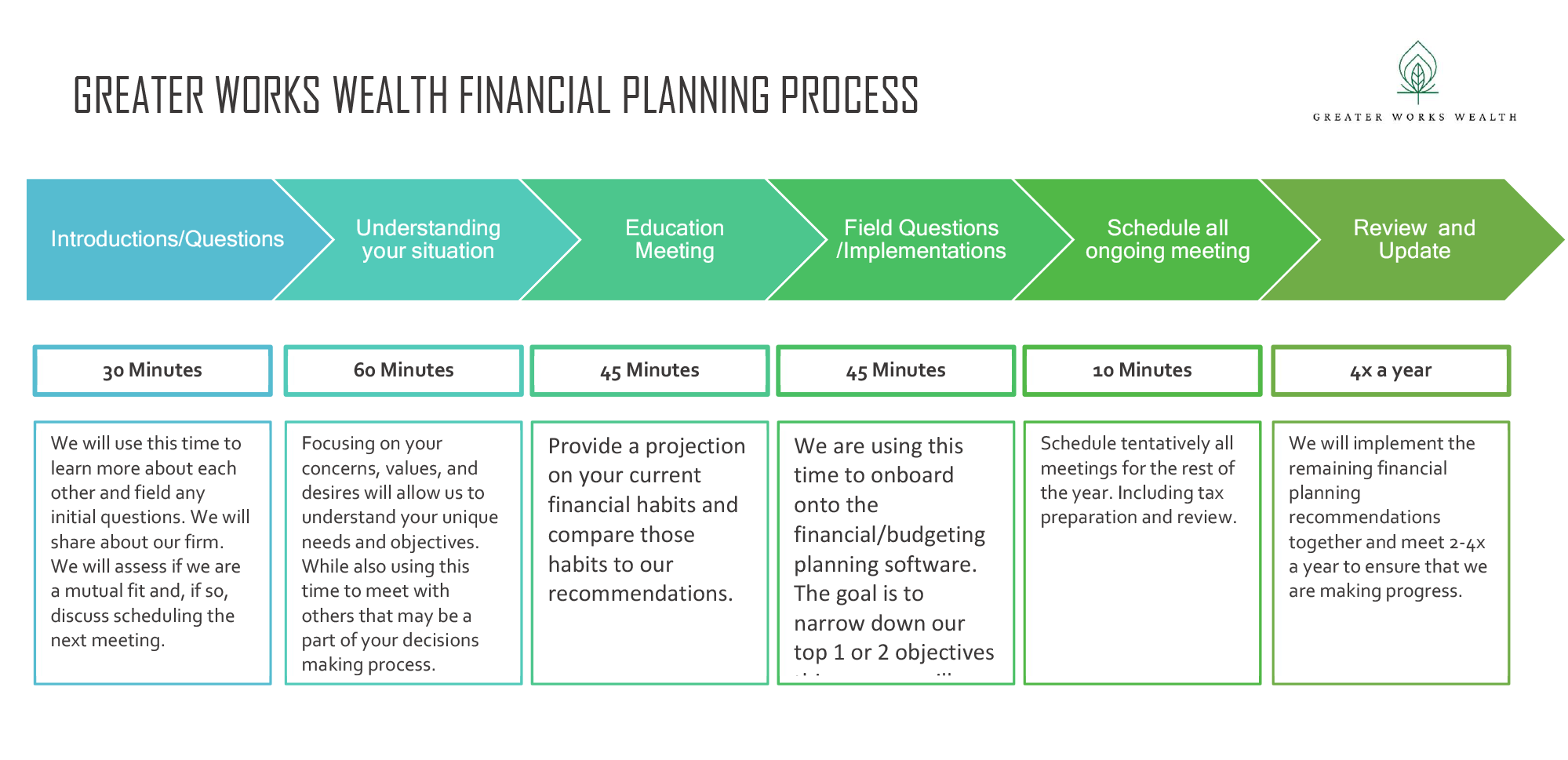

Process

Ongoing Financial Planning - Schedule A

We charge a recurring fixed fee for Ongoing Financial Planning. Fees are paid monthly or quarterly in arrears, ranging from $150 to $500 per month or $450 to $1,500 per quarter. The client can opt to pay an annualized fee at the end of the service. The fee range is dependent upon variables including the specific needs of the Client, complexity, estimated time, research, and resources required to provide services to you, among other factors we deem relevant. Fees are negotiable and the final agreed upon fee will be outlined in your Advisory Contract.

Wealth Management - Schedule A

The fee is based on a percentage of assets under management (“AUM”) and is negotiable. For accounts with more than $500,000 in AUM, investment management and financial planning services are included in the AUM fee. For accounts with less than $500,000 in AUM, the fee is a combined fee for investment management and for financial planning.

The annualized fees for investment management services are based on the following fee schedule:

Assets Under Management Annual Advisory Fee

$0 - $500,000 1.25%

$500,001 - $2,000,000 1.00%

$2,000,001 - $5,000,000 0.65%

$5,000,001 and Above 0.50%

The annual advisory fee is paid quarterly in arrears based on the average daily balance of the Client’s account(s). The advisory fee is a straight tier. For example, for assets under management of $2,000,000, a Client would pay 0.65%. The quarterly fee is determined by the following calculation: (($2,000,000 x 0.65)) ÷ 4 = $3,250.