Target Audience:

Businesses that care about their employees.

Common Problems:

- Tax strategy

- Missed contributions or unwanted distributions

- No integrations

- Need help understanding Secure Act 2.0

- A lack of services from current advisor

- A lack of fiduciary duties/operations

- Compliance testing issues

- Want to start a 401K plan

Scenario:

Business owners are starting to scale, and profits are increasing. They want to offer their employees benefits to attract and retain talent. He also cares about the employees’ future and wants them to be able to save for retirement. With the increasing success in the business, they are having personal taxable income issues. The owner has no idea where to start but wants to know he and his team are doing the right things.

Solutions:

- Tax Breaks: with a retirement plan, a business owner could potentially place anywhere from 20,500 – 500K tax deductible into a retirement plan.

- Fiduciary Duties: implement a fiduciary training calendar where we provide and facilitate documentation and training to complete fiduciary duties.

- Participation and education: provide plan design support to allow the participant to succeed. Participants have access to 1 on 1 meeting with a financial planner.

- Review: We conduct fee analysis quarterly with comprehensive research and repricing of the plan every 3yrs.

Outcome:

The Company can provide a tax benefit to the employer and employees with confidence knowing that as the Company grows, they are executing its fiduciary duties. While also putting the 401(k) plan participants in the best position to retire with a quality of living and offer competitive benefits.

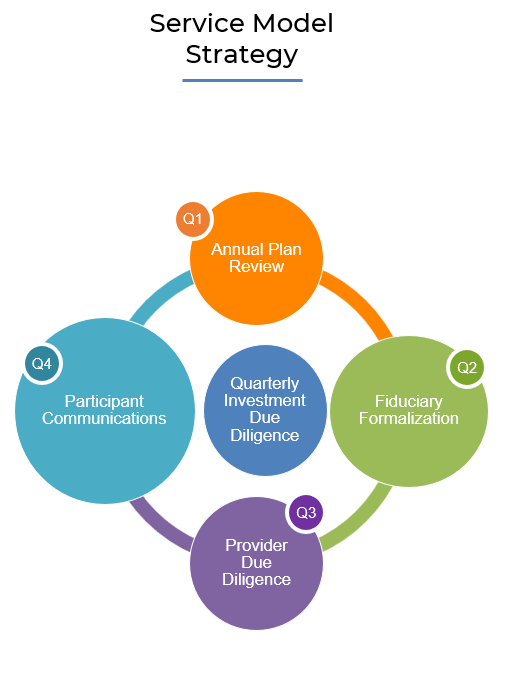

Service Model Strategy

401(k) Planning Process Timeline is most appropriate for the following:

Retirement Plan Consulting

The fee is based on a percentage of assets under management and is negotiable. The annualized fees for retirement plan investment consulting services are based on the following fee schedule:

Assets Under Management Annual Advisory Fee

$1,000,001 - $5,000,000 0.50% - 1.00%

$5,000,001 - $10,000,000 0.35% - 0.50%

There is a minimum annual fee of $5,000, however, exceptions may be granted to this at the discretion of GWW. Please note, the minimum fee may prevent GWW from providing services to very small plans. The annual advisory fee is paid monthly or quarterly in arrears based on the average daily balance of the Client’s account(s). The client can opt to pay an annualized fee at the end of the service. The advisory fee is a straight tier.

This does not include fees to other parties, such as record keepers, custodians, or third-party administrators. GWW relies on the valuation as provided by Client’s custodian in determining assets under management. Our advisory fee is prorated for any partial billing periods occurring during the engagement, including the initial and terminating billing periods.

There are two ways that a plan might pay GWW’s fee: an employer may pay our fee or the plan may pay our fee. If an employer pays, GWW’s fee will be paid from the employer’s money without using the plan’s assets. Concerning a Governmental Plan, we may refuse to accept payment from an Employer if we believe that the Employer lacks authority to pay our fee. In order for a plan to pay GWW’s fee, the named fiduciary or trustee must have and use a power to pay us, or to instruct a corporate-directed trustee or insurer to pay us. The named fiduciary or trustee must also decide how to allocate that expense among the plan’s accounts, which may include participants’ plan accounts.

Advisory Fee Disclaimer: Lower fees for comparable services may be available from other sources.

Downloads

Flowchart: Should I start a traditional 401(k) Plan for my business?

Download types of retirement plans